If you don’t owe and aren’t responsible for any portion of the debt

If you’re an injured spouse, you must file a Form 8379, Injured Spouse Allocation, to let the IRS know. You need to file Form 8379 for each year you’re an injured spouse and want your portion of the refund. You can file this form before or after the offset occurs, depending on when you become aware of the separate debt, and can file it with your electronic tax return.

If you’re filing Form 8379 with your original joint return (IRS Forms 1040, 1040A, or 1040-EZ), by mail, before the IRS makes an offset:

- Write “INJURED SPOUSE” in the top left-hand corner of the first page of the joint tax return.

- Follow the instructions on Form 8379 carefully and attach it to your return.

If you’re filing Form 8379 with your amended joint return (Form 1040X), by mail, before or after the IRS makes an offset:

- Show both your and your spouse’s Social Security numbers in the same order as they appear on your original joint tax return.

- You, the “injured” spouse, must sign the Form 8379.

- Follow the instructions on Form 8379 carefully and attach the required forms to avoid delays.

If you’re sending Form 8379 by itself, be sure to send it to the IRS address where you filed your original return (or the IRS address for the area where you live if you filed your original return electronically). You can find the addresses at Where to File Your Individual Return page on IRS.gov.

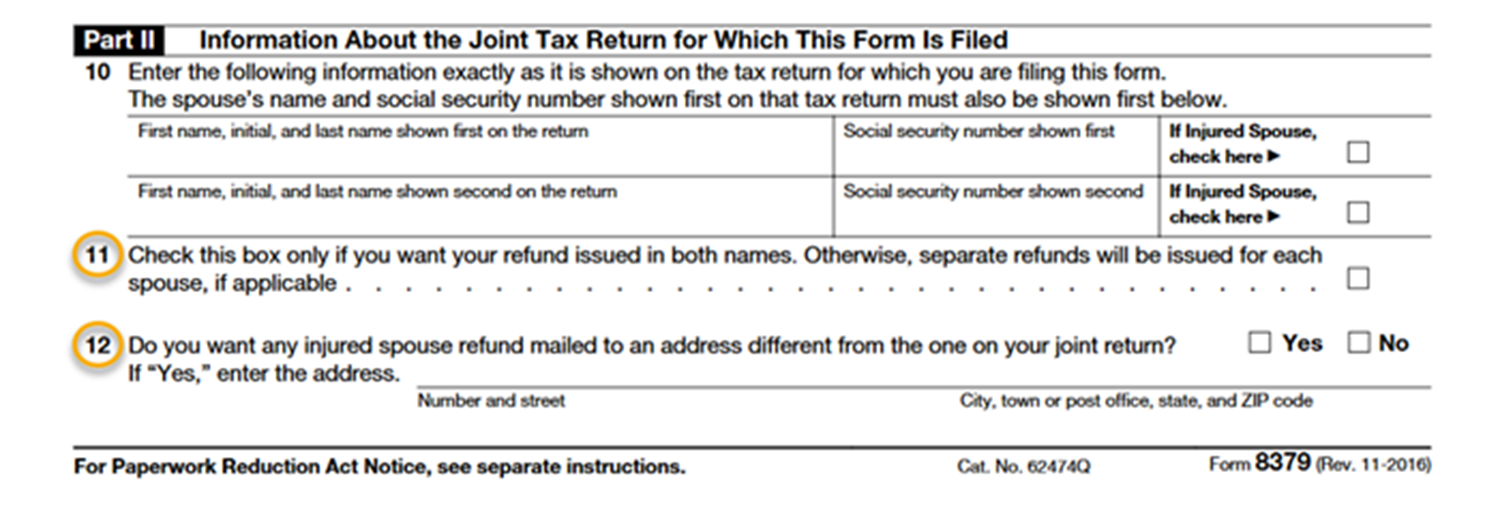

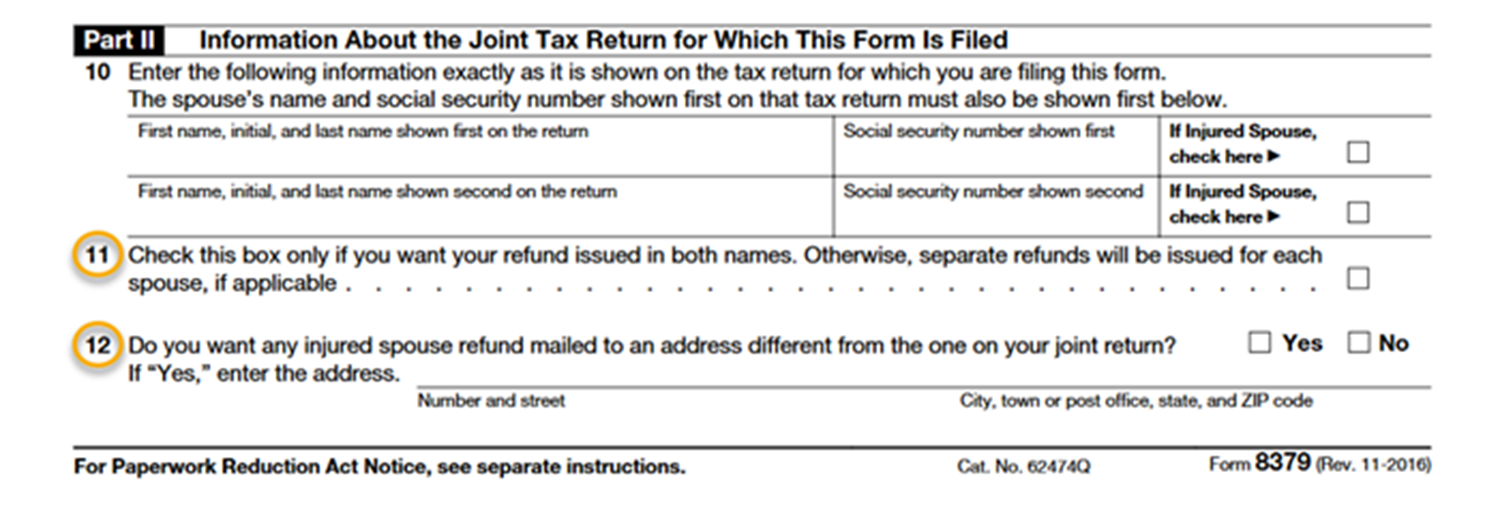

Important information about your refund: On Form 8379, be careful to read and answer the questions on Lines 11 and 12, if they apply to you.

- Check the box on Line 11 only if you want your refund to be issued with both your and your spouse’s names.

- Don’t check the box on Line 11 if you’re divorced, separated from, or no longer living with the spouse with whom you filed the joint return.

- If the refund check is issued in both names, and you no longer maintain a joint account with the other person, you may have trouble getting the check cashed.

- The box on Line 12 lets you decide if you want your injured spouse refund to be sent to an address different from the one on your joint return.

If you’re responsible for the debt

If you’re responsible for the debt, you’re generally not an injured spouse. See Offsets for more information.