Small Business Health Care

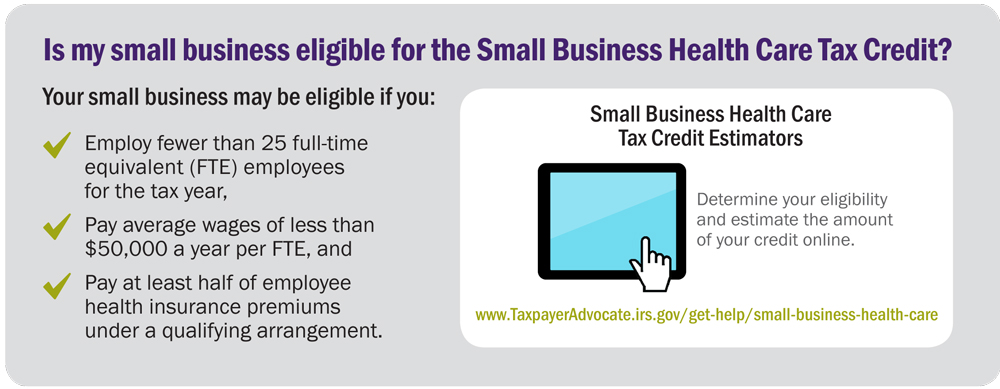

Under the Affordable Care Act, small businesses and tax-exempt organizations that meet certain qualifications are eligible for a Small Business Health Care Tax Credit (SBHCTC).

Under the Affordable Care Act, small businesses and tax-exempt organizations that meet certain qualifications are eligible for a Small Business Health Care Tax Credit (SBHCTC).

The credit helps you provide health insurance to your employees for the first time or maintain coverage you already offer. The Small Business Health Care Tax Credit Estimator helps determine whether you’re eligible for the credit for tax years 2014 and beyond and if so, estimate the amount.

The Taxpayer Advocate Service developed the Small Business Health Care Tax Credit Estimator to help you find out whether you’re eligible for the Small Business Health Care Credit and how much you might receive.

Download the full Small Business Health Care Tax Credit fact sheet.

Is your business or organization eligible for the credit?

Generally, you qualify for the credit if:

Starting in 2014, you also must pay premiums on behalf of employees enrolled in a qualified health plan offered through a Small Business Health Options Program (SHOP) Marketplace, or qualify for an exception to this requirement. However, the exceptions are extremely limited.

Some notes about full-time equivalent (FTE) employees

To determine if you have fewer than 25 FTE employees, you must consider how many hours each employee works.

The instructions for Form 8941, Credit for Small Employer Health Insurance Premiums include a worksheet to calculate your total FTE employees.

As of tax year 2014, to qualify for this credit, you must purchase insurance for your employees through the Small Business Health Options (SHOP) Marketplace.

To claim the credit, tax-exempt organizations must file an Form 990-T, Exempt Organization Business Income Tax Return, even if they don’t normally file one.

For some tax-exempt organizations, the SBHCTC is a refundable credit. This means if it’s more than the tax you owe, you may get a refund. Small businesses may be able to carry the credit back or forward to other tax years.

The amount of the credit changes over time. For tax years 2014 and later:

Beginning in 2014, the credit is only available to you for two consecutive years.

For more information about the Affordable Care Act and how it affects your taxes, visit our

Browse common tax issues and situations at

If your IRS problem is causing you financial hardship, you’ve tried repeatedly and aren’t receiving a response from the IRS, or you feel your are not being respected, consider

You may be eligible for representation from an attorney, certified public accountant (CPA), or enrolled agent (EA) associated with a Low Income Taxpayer Clinic (LITC). LITCs may also provide information about taxpayer rights and responsibilities in different languages for individuals who speak English as a second language.

The rules for qualifying for the Small Business Healthcare Credit and the credit amounts allowed vary each year, so be sure to use the appropriate estimator based on the specific the tax year you need. The estimator for prior tax years can assist with qualifications and credit estimates in case small employers are considering amending an existing tax return.