Subscribe to the NTA’s Blog and receive updates on the latest blog posts from National Taxpayer Advocate Erin M. Collins. Additional blogs can be found at dev.taxpayeradvocate.irs.gov/blog.

In this week’s blog, I highlight my concerns with the IRS Free File program, which I also discussed in my 2018 Annual Report to Congress and my recent testimony before the House Ways and Means Subcommittee on Oversight. I also describe my personal experience using Free Fillable Forms and make some recommendations for improving these products. This is a bit of a long post, but the topic requires some background discussion to understand how we got to where we are today.

Background

The IRS Restructuring and Reform Act of 1998 directed the IRS to set a goal of increasing the e-file rate to at least 80 percent by 2007. In 2002, the IRS entered into an agreement with a consortium of tax software companies, known as Free File, Inc. (FFI), under which the companies would provide free tax return software to a certain percentage of U.S. taxpayers, and in exchange, the IRS would not compete with these companies by providing its own software to taxpayers. The agreement has been renewed at regular intervals, and for at least the past decade, the agreement has provided that the consortium would make free tax return software available for 70 percent of taxpayers (currently, about 105 million), particularly focusing on increasing access for economically disadvantaged and underserved communities, as measured by adjusted gross income.

The program provides two return preparation options for taxpayers that can be accessed on the IRS.gov homepage:

The Services Provided by Free File, Inc. Fail to Meet the Needs of Taxpayers, and Use of the Program Continues to Decline

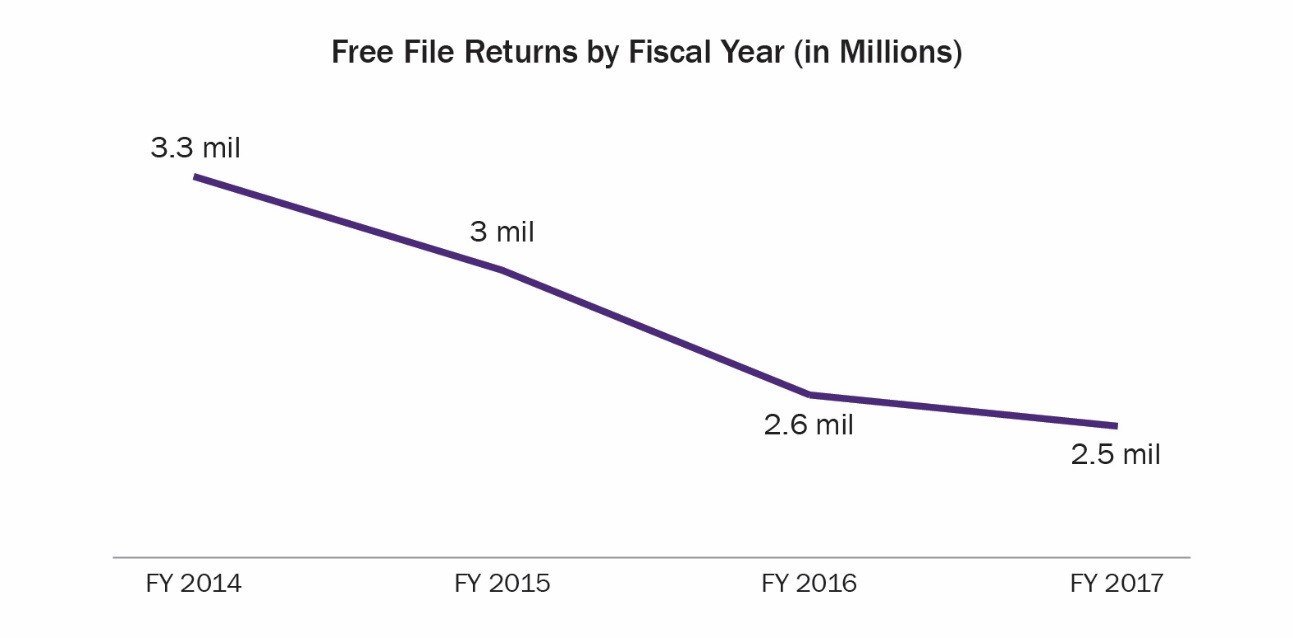

While e-filing has increased by over 180 percent since 2002, use of the Free File program has not. In 2018, individual taxpayers filed more than 154 million tax returns. Yet fewer than 2.5 million of those returns, or 1.6 percent, were filed using Free File software (this calculation does not include the number of taxpayers who used Free Fillable Forms to file their tax returns). Thus, about 68 percent of all taxpayers were eligible to use Free File software but did not do so—frequently paying to purchase the same or comparable software instead. In fact, use of the Free File program has decreased since 2014—meaning that taxpayers who used Free File in previous years chose a different option to file their returns in the following year.

In comparison, paid preparers filed almost 78.6 million tax returns electronically in tax year 2017. Over 3.5 million returns were prepared through Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs, a higher number than prepared by FFI despite the fact that taxpayers must expend more time and resources to go to one of these sites.

In addition, data on repeat usage suggest Free File users are widely dissatisfied with the program. Among taxpayers who used Free File software in 2017, the majority (51 percent) did not use Free File software again in 2018.

Why do so few taxpayers use Free File, instead often opting to pay for the same or comparable software? Are taxpayers unaware of these services or unwilling to use them? In my 2018 Annual Report to Congress, I identified the Free File program as one of the Most Serious Problems faced by taxpayers. I am concerned that the IRS devotes minimal resources to overseeing and testing this program, to understanding why so few eligible taxpayers are using it, and to considering how the service offerings could be improved.

I identified the following specific shortcomings:

My own personal experience with Free File is instructive. As most readers know, for almost two decades, I have advocated that the IRS create an electronic analogue to the paper Form 1040, instructions and publications so taxpayers can electronically prepare and file their tax returns for free. I’ve recommended the product do basic math and transfer numbers from one form to another (thus avoiding computation and clerical errors), and link to specific line instructions and publications, including fillable worksheets. The Free Fillable Forms product on Free File satisfies most of those requirements, and I have used that product to prepare my own tax return since its inception.

Free Fillable Forms is not without its flaws. Each year I discover glitches, which I convey to the IRS, and the 2018 filing season was no exception. As I entered my information into the main Form 1040, I discovered that the links to the instructions did not function properly. Thus, I had to log back and forth between the IRS.gov website to read the 1040 instructions and look up my tax rate, and the Free Fillable Forms site to enter the information into the electronic 1040. When I hit the “Save” button at the top of the screen, I was not provided the option of saving the return to my personal computer. When I attempted to print out my tax return, I was not able to print out the entire return. Instead, I could print out the individual schedules one-by-one, but I could not print out the 1040.

I thought about just going to the IRS website and printing out a blank 1040 and transcribing the numbers from the Free Fillable form 1040, so I could have a complete copy of my return. But that might look suspect—to have a handwritten 1040 with printed schedules—if I were to submit my return for a loan application or some other purpose. So, I went back to IRS.gov, printed off a Form 1040 on paper, filled in the lines on the paper Form 1040 with the information from Free Fillable Forms, then went back to IRS.gov and transcribed the numbers from the paper 1040 onto the “fillable-pdf” Form 1040, and, finally, printed off the “fillable-pdf” Form 1040 and put it together with the other schedules I had printed from Free Fillable Forms.

Oof. Is it any wonder usage is so low? Not everyone is going to be as stubborn as the National Taxpayer Advocate; most would have abandoned the product when they learned they couldn’t link to instructions.

Testing by TAS found that several software providers on Free File have limitations in their navigational features and ability to help taxpayers correctly complete their returns, resulting in poor service quality. In addition, cross-marketing and advertising of other services on Free File software platforms can confuse and frustrate taxpayers, probably contributing to the low repeat-usage rate. Because Free File software programs are accessed through IRS.gov, taxpayers may be under the false impression that the IRS endorses the Free File products available there, and thus a poor experience with Free File may reflect poorly on the IRS and can erode taxpayers’ trust in fair tax administration.

Can the Program Be Improved?

Preliminary data for the 2019 filing season show that, as of March 8, 2019, Free File usage slightly increased by five percent, compared to the same time period in 2018. The increase may be attributed to the following new features:

It should be emphasized that a five percent increase in the use of Free File software, while positive, amounts to only about 124,000 additional Free File returns. Put differently, it would have caused the percentage of taxpayers using Free File software last year to increase from 1.6 percent of all filed returns to 1.7 percent of all filed returns.

To achieve a discernible increase in Free File participation, I recommend the IRS take the following steps:

However, if the IRS continues to show no appetite for monitoring and overseeing, including testing, its Free File offerings, I recommend it terminate that aspect of the program and instead focus on improving and promoting Free Fillable Forms. At any rate, the IRS should improve Free Fillable Forms by: