TAXPAYER SERVICE: The IRS Has Developed a Comprehensive “Future State” Plan That Aims to Transform the Way It Interacts With Taxpayers, But Its Plan May Leave Critical Taxpayer Needs and Preferences Unmet

During the past year and a half, the IRS has developed a “future state” plan that is likely to bring about a fundamental transformation in the way it treats taxpayers. There are many positive components of the plan, including the goal of creating online accounts through which taxpayers will be able to obtain information and interact with the IRS.

But the plan also raises at least two significant concerns.

First, implicit in the plan – and explicit in internal discussions – is an intention on the part of the IRS to substantially reduce telephone and face-to-face service.

Second, to the extent taxpayers require help, the IRS is developing procedures to enable third parties like tax return preparers and tax software companies to provide it – an approach that will increase taxpayer compliance costs.

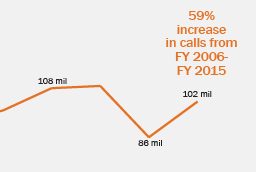

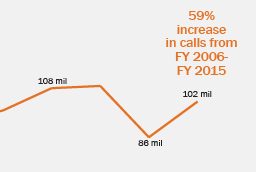

The IRS receives more than 100 million taxpayer calls and five million taxpayer visits each year, so a significant reduction in these services will leave taxpayer needs unmet and force millions of taxpayers to pay for help, and generate additional taxpayer frustration with the IRS. As a result, confidence in the fairness of the tax system may erode, and taxpayer frustration and alienation may lead over time to a lower rate of voluntary compliance.

In June, the National Taxpayer Advocate recommended that the IRS make its plan public and seek comments from taxpayers, practitioners, and others. To date, the IRS has not done so.

In this report, the National Taxpayer Advocate reiterates her recommendation that the IRS immediately publish its plan and solicit public comments, and recommends that Congress hold hearings during the next few months on the future state of IRS operations.