TAX CODE REFORM

TAX CODE REFORM

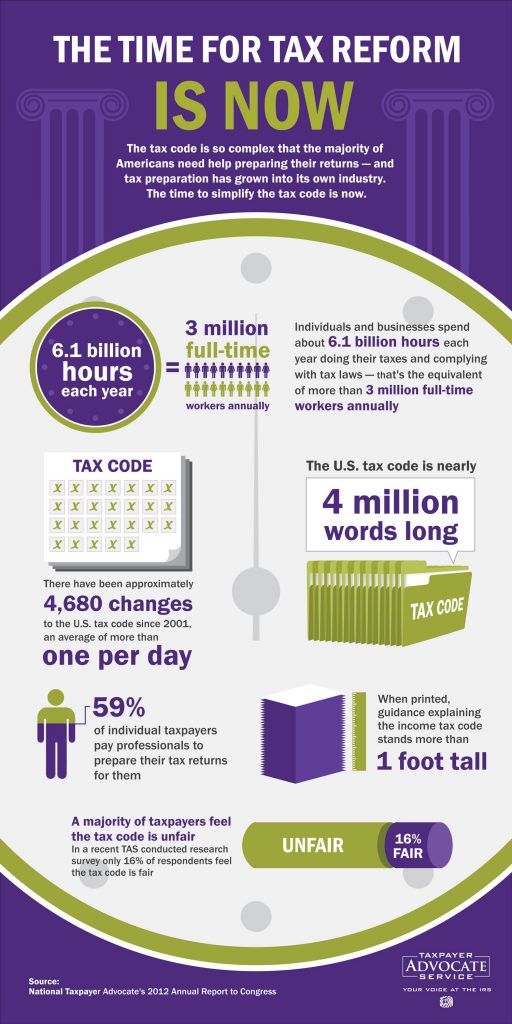

The most serious problem facing taxpayers – and the IRS – is the complexity of the Internal Revenue Code (the “tax code”). A simpler, more transparent tax code will substantially reduce the estimated 6.1 billion hours and $168 billion that taxpayers (individuals and businesses) spend on return preparation; reduce the likelihood that sophisticated taxpayers can exploit arcane provisions to avoid paying their fair share of tax; enable taxpayers to understand how their tax liabilities are computed and prepare their own returns; improve taxpayer morale and tax compliance – and perhaps even the level of connection that taxpayers feel with the government; and enable the IRS to administer the tax system more effectively and better meet taxpayer needs.

The National Taxpayer Advocate believes fundamental tax reform is essential and urgent. We believe that taxpayers will support tax reform by wide margins if they better understand the trade-offs involved and can be part of an informed dialogue. The report recommends that Congress approach tax reform in a manner similar to zero-based budgeting. Under this methodology, the starting assumption would be that all tax expenditures would be eliminated. A tax break would then be retained only if a compelling case can be made that the benefits of providing that tax break outweigh the complexity burdens it creates. At the same time, Congress can separately consider how much revenue it wants to raise, and then it can marry up our optimally designed tax system with our revenue needs by setting tax rates accordingly.

“To alleviate taxpayer burden, the National Taxpayer Advocate urges Congress to simplify the tax code. In general, this means Congress should look at each provision in the code and ask questions like: ‘Does this government incentive make sense?’; ‘If it does, is it better administered through the tax code or as a direct spending program?’; ‘However well intentioned, is it doing what it was intended to do?’; and ‘If yes, can it be administered without imposing unreasonable burdens on taxpayers or the IRS?’. A tax benefit should be retained only if Congress determines that the public policy benefits of keeping it outweigh the complexity burden it imposes.”

– Nina Olson, National Taxpayer Advocate

THE IRS FAILS TO HELP HUNDREDS OF THOUSANDS OF IDENTITY THEFT VICTIMS

THE IRS FAILS TO HELP HUNDREDS OF THOUSANDS OF IDENTITY THEFT VICTIMS ALTERNATIVE MINIMUM TAX CONTINUES TO BURDEN TAXPAYERS

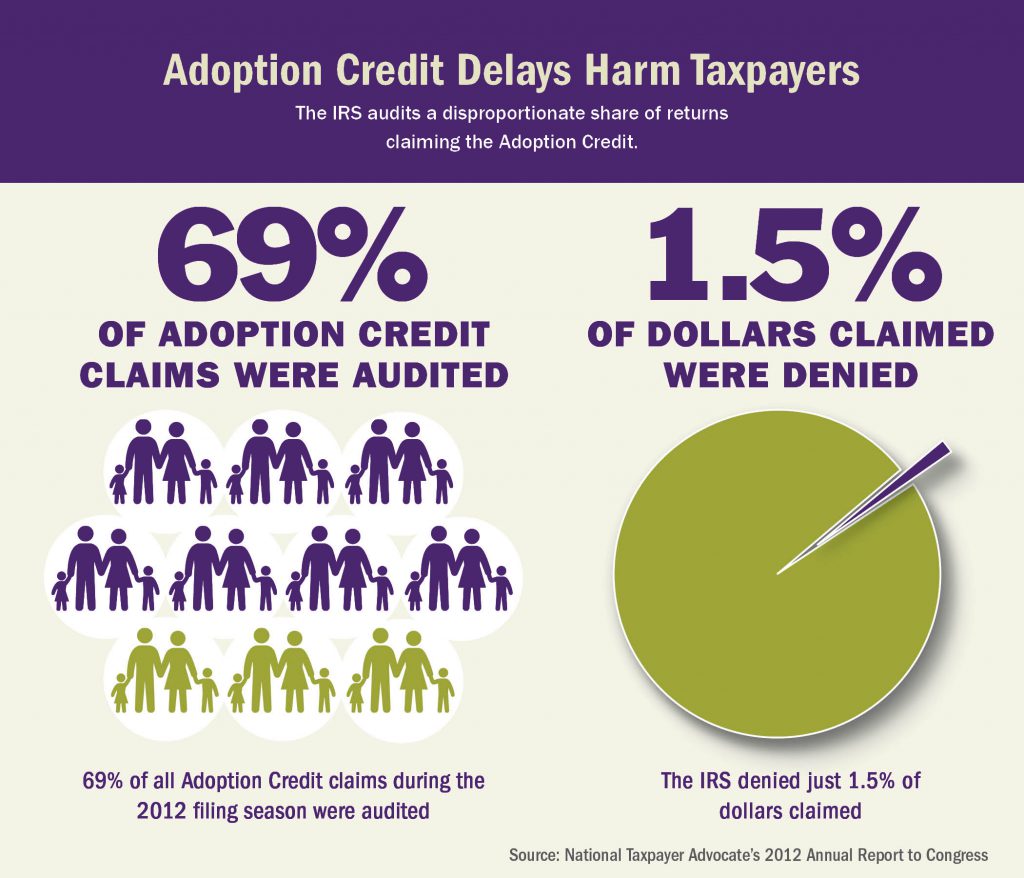

ALTERNATIVE MINIMUM TAX CONTINUES TO BURDEN TAXPAYERS ADOPTION CREDIT DELAYS HARM TAXPAYERS

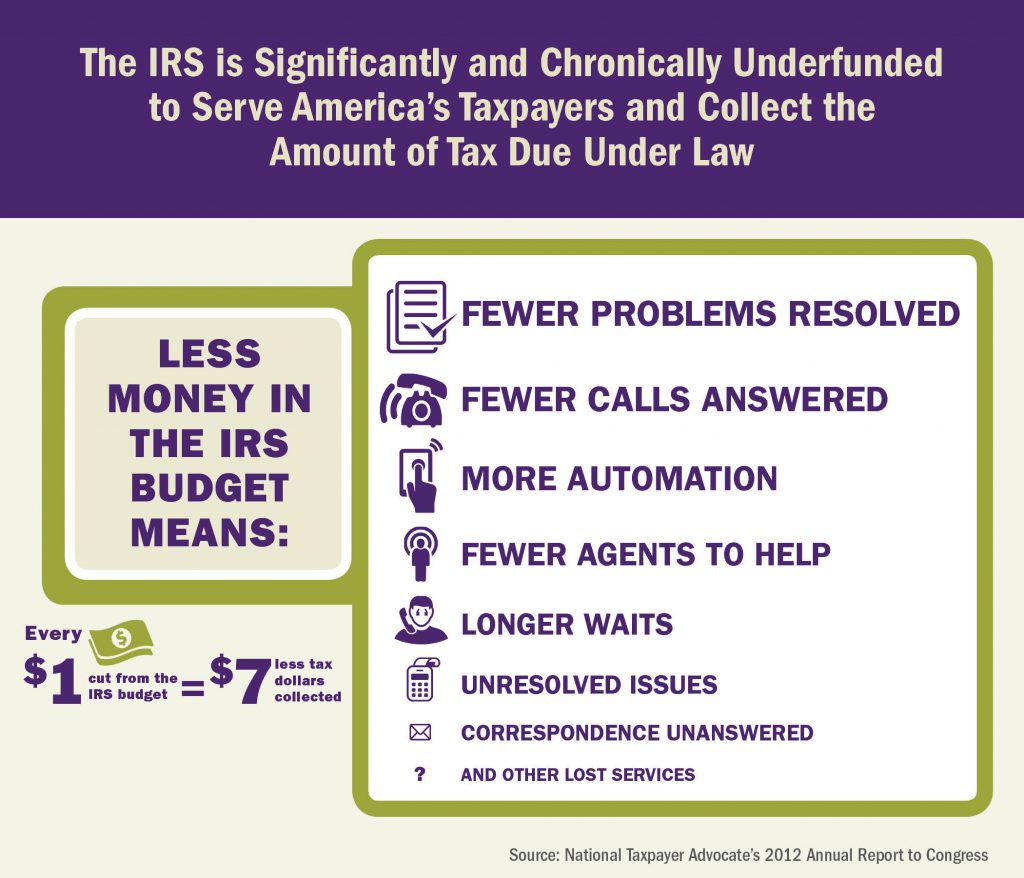

ADOPTION CREDIT DELAYS HARM TAXPAYERS IRS UNDERFUNDED TO SERVE TAXPAYERS, COLLECT TAX

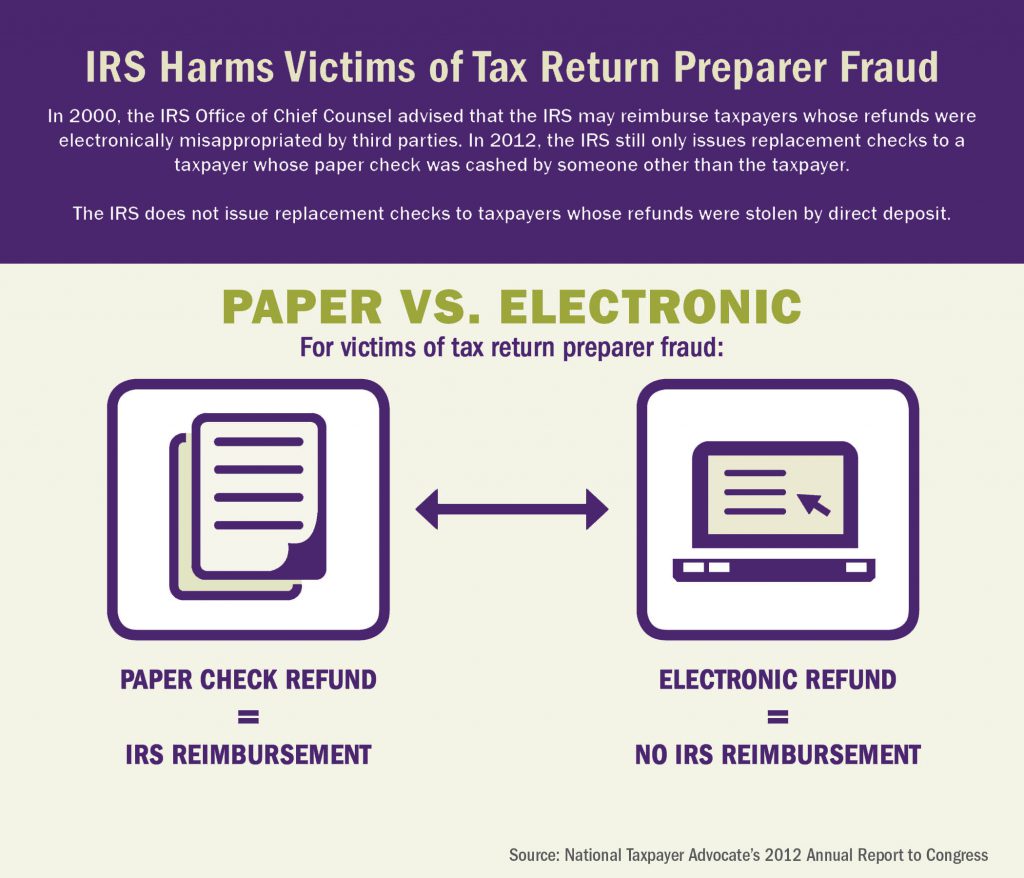

IRS UNDERFUNDED TO SERVE TAXPAYERS, COLLECT TAX VICTIMS OF RETURN PREPARER MISCONDUCT NEED MORE HELP FROM THE IRS

VICTIMS OF RETURN PREPARER MISCONDUCT NEED MORE HELP FROM THE IRS